lowest sales tax in orange county california

1496 rows Lowest sales tax NA Highest sales tax 1075 California Sales Tax. Balboa Island Newport Beach 7750.

Robert Citron Was A Hard To Hate Villain In O C S Bankruptcy Orange County Register

1788 rows Orange.

. Several cities in this area have 10 percent rates while nearby Stanislaus County has a 76 percent rateone-eighth of a cent above the minimum. The December 2020 total. 68 Lowest sales tax in California.

Sales Tax in Orange County is one of the lowest in all of California. Balboa Park San Diego 7750. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

California Sales Tax. What is the sales tax rate in Orange County. The current sales tax in Orange County California is 775.

Taxes break down to federal state and local levels. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Orange County California is.

The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county. The most populous zip. This tax does not all go to the state though.

California has state sales tax of 6 and allows local. The minimum sales tax in California is 725. The Orange sales tax rate is 0.

The true state sales tax in California is 6. It is 775 6 state-owned and 175 county-owned. California CA Sales Tax Rates by City.

This is the total of state and county sales tax rates. Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025. 82 rows California has a 6 sales tax and Orange County collects an additional 025 so the.

The statewide tax rate is 725. The current total local sales tax rate in Orange County CA is 7750. Orange County CA Sales Tax Rate The current total local sales tax rate in Orange County CA is 7750.

Those district tax rates range from 010 to. Average Sales Tax With Local. 69 Anaheim sales tax.

With local taxes the total sales tax rate is between 7250 and 10750. The December 2020 total local sales tax rate was also 7750. The state sales tax rate in California is 7250.

The bottom panel of the. As far as all cities towns and locations go the place with the highest sales tax rate is Los Alamitos and the place with the lowest sales tax rate is Aliso Viejo.

Southern California Ends 2017 With House Price Gains Sales Declines Orange County Register

2022 Property Taxes By State Report Propertyshark

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Home Sales Plunge In Southern California And Prices Level Off As Mortgage Rates Rise Orange County Register

Top 10 Most Affordable Places To Buy In Orange County

California Sales Tax Rates Vary By City And County Econtax Blog

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Florida Sales Tax Rates By City County 2022

California Gas Tax Increase Enjoy Oc

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Solar Panel Cost In Orange County Ca 2022 Guide Energysage

Orange County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

California Sales Tax Rates By City September 2022

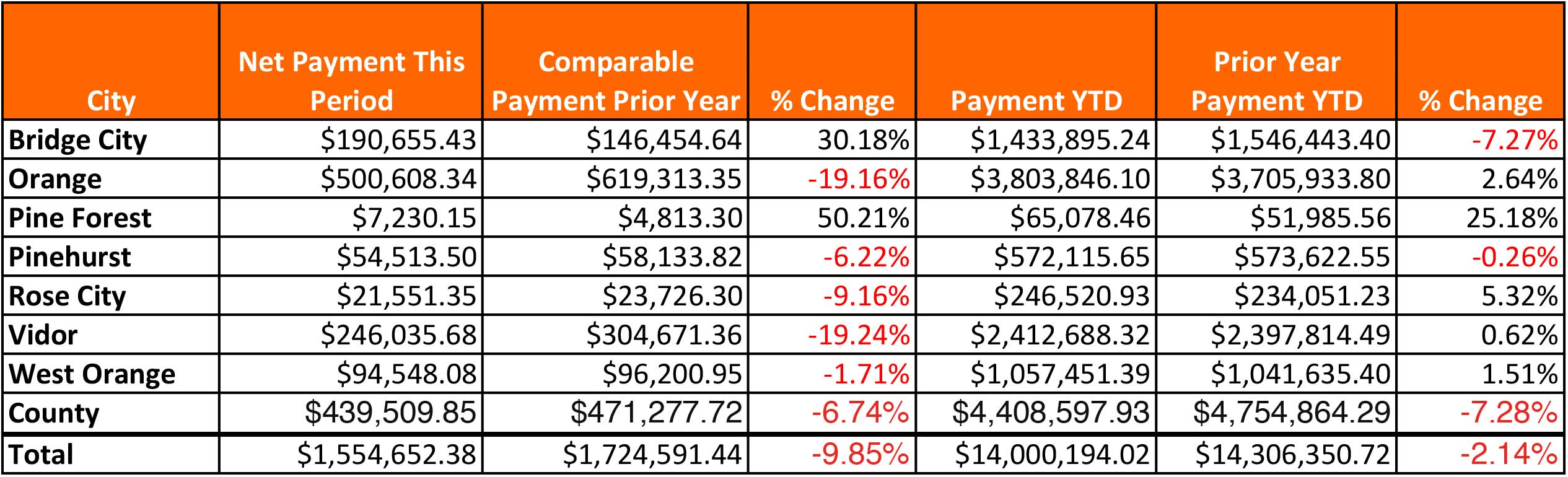

Sales Tax Down For Most Of Orange County Orange Leader Orange Leader

Orange County Real Estate Market Report And Trends

State By State Guide To Economic Nexus Laws