45l tax credit requirements

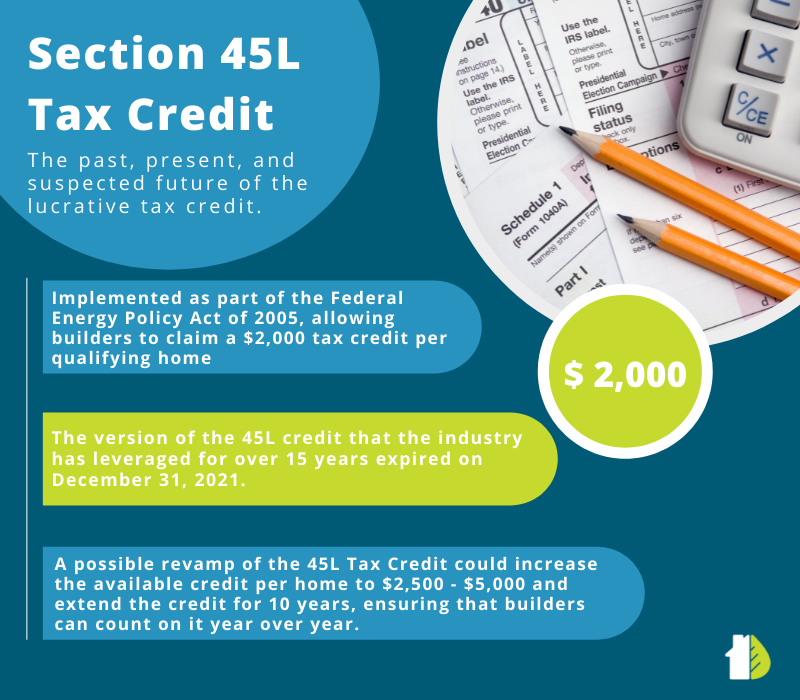

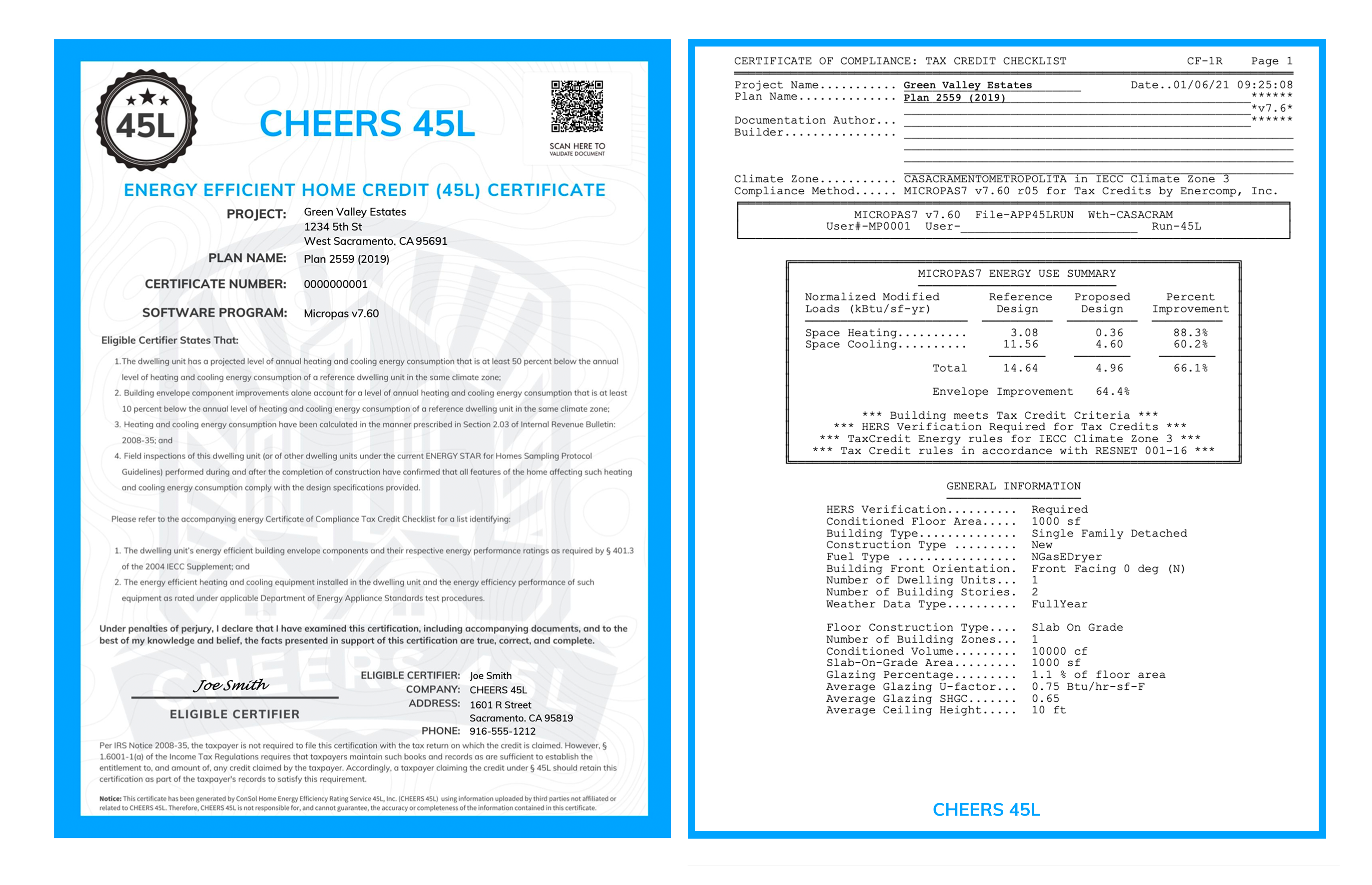

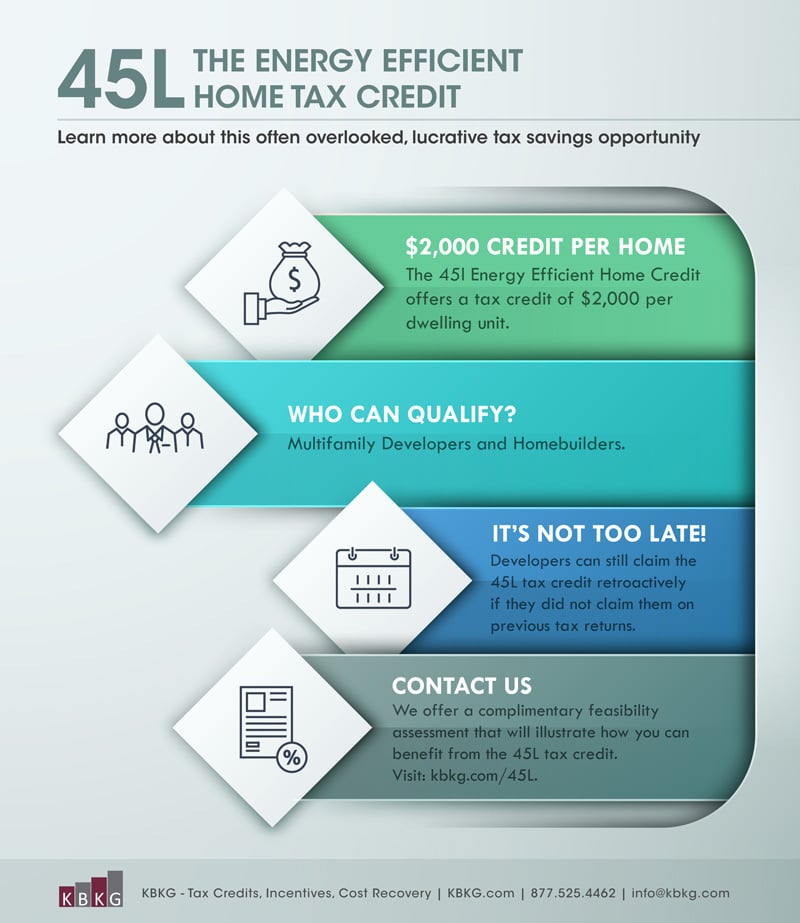

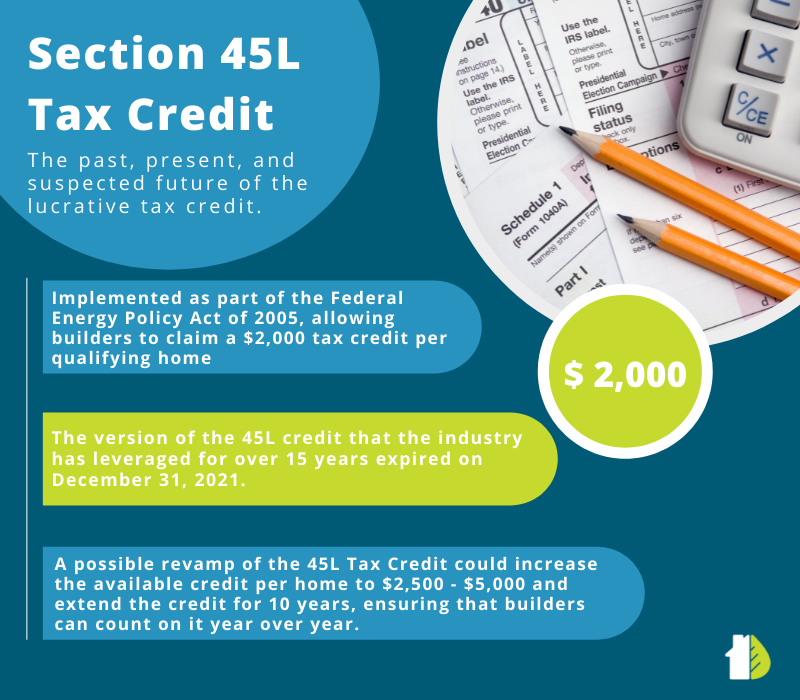

C Energy saving requirements A dwelling unit meets the energy saving requirements of this subsection if such unit is 1 certified A to have a level of annual. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

45l The Energy Efficient Home Credit Extended Through 2017

The Low-Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today.

. As a reminder to qualify for the 45L tax credit properties must incorporate energy-efficient features such as high R-value insulation and roofing HVAC systems andor windows. For qualified new energy efficient homes other than manufactured homes. The Energy Efficient Home Credit offers a tax credit of 2000 per dwelling unit to developers of energy efficient buildings completed after August 8 2005.

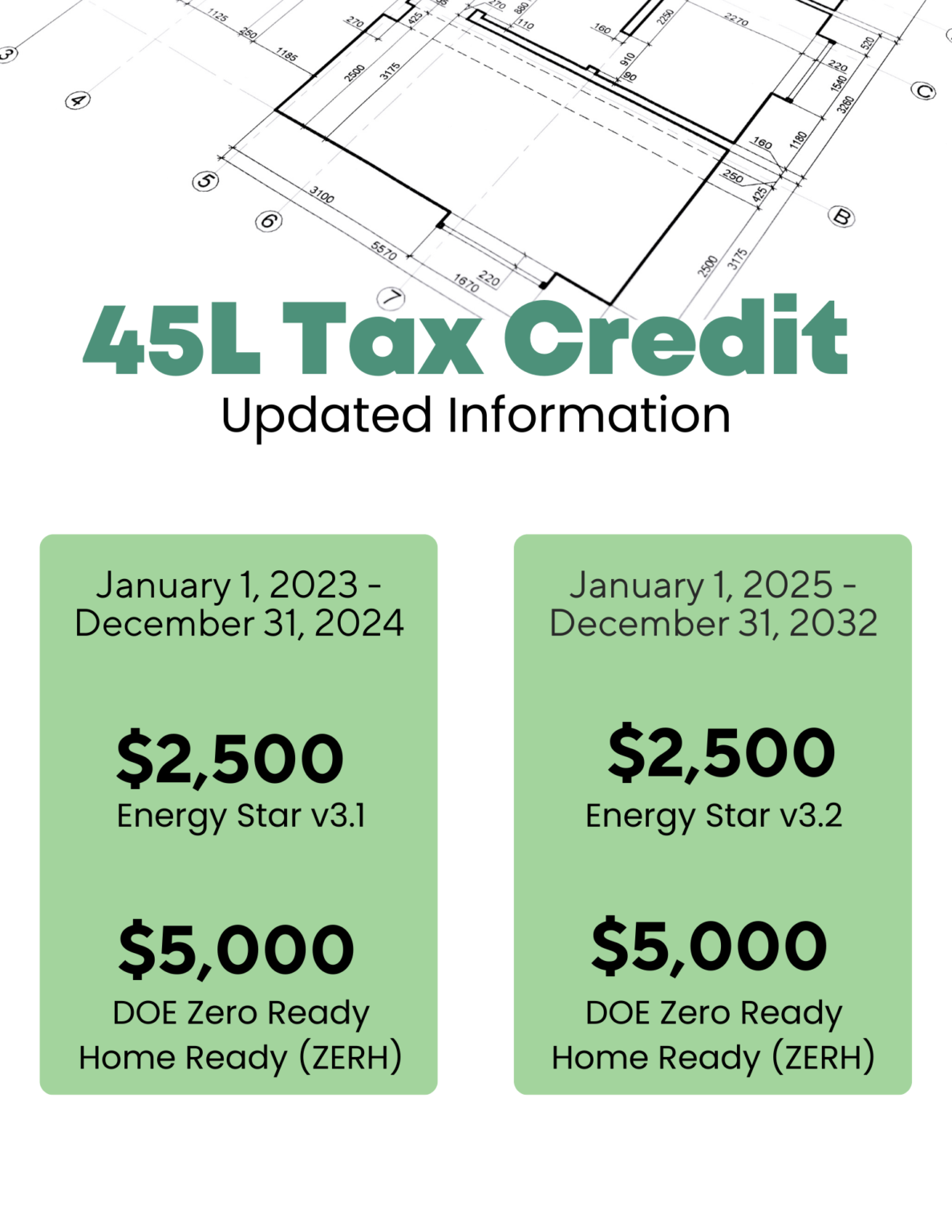

Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L was extended increased and modified under the Inflation Reduction Act of 2022. Start Your Tax Return Today.

Check Out the Latest Info. Sold or leased as a residence the credit can be taken retroactively for three years back or to any open tax year. Owners Can Receive Up to 26000 Per Employee.

Do You Own a Business w 5 or More W-2s. Ad All Major Tax Situations Are Supported for Free. Tax Credits Rebates Savings.

The 45L Tax Credit applies to single-family homes as well as apartment. Be at least 50 more efficient than the 2006 IECC benchmark. Ad 45l tax credit requirements.

The credit is worth roughly 10 of total. To qualify for the 2000 tax credit an eligible dwelling must. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal.

Browse Our Collection and Pick the Best Offers. CTCAC allocates federal and state tax credits to the developers of these projects. The RD Tax Credit is for any company that spends time developing new improved and more reliable products software processes and formulas.

Corporations provide equity to build the projects in return for the tax credits. Below is a sample of expected. 45l Tax Credit Requirements.

2000 per qualified home Single family and multi-family projects up to. Created by the Tax Reform Act of 1986 the. Alternatively manufactured single-family homes qualify for the 2500 tax credit if the meet the Energy Star Manufactured Home National program requirements as in effect on.

For multifamily homes constructed after 2022 the Act provides a 45L tax credit of 500 when meeting the ENERGY STAR Single Family New Homes Program or 1000 when meeting the. TCAC verifies that the. Efficiency compliance must be verified with DOE approved 45L.

To qualify for the full 179D deduction under the old rules a taxpayer needed to show an energy savings of 50 as measured by the American Society of Heating Refrigerating. The energy-efficient home credit provides developers a tax credit of up to 2000 per qualifying unit if they can certify the energy-saving qualities of the residence. See If Your Business Qualifies For the Employee Retention Tax Credit.

Next Up On 45l Federal Tax Credit Ducttesters Inc

Collect 2 000 Tax Credit For Each New Home Or Dwelling Unit Built Tax Credits The Unit Energy

45l Tax Credit Services Using Doe Approved Software

Contractors Securing Work With The 45l Tax Credit Aeroseal

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Back Taxes Help Tax Debt Help New York Washington Dc Tax Help Irs Taxes Income Tax Preparation

45l Tax Credit Energy Efficient Tax Credit 45l

45l Tax Credit Overview And Analysis Of The Residential Efficiency Energy

Section 45l Energy Tax Credit Past Present And Future Ekotrope

Roof Reflectance Emittance What Qualifies As A Cool Roof What Triggers Cool Roof Requirements Exceptions Roofreflectance Cool Roof Energy Title 24

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

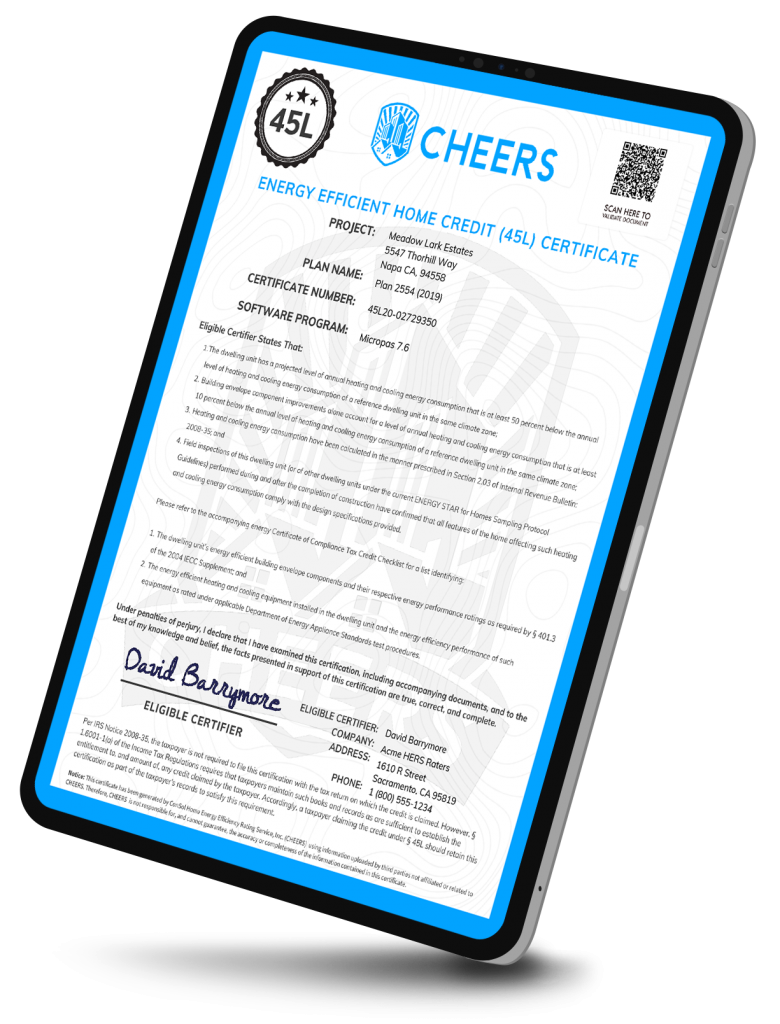

What Is The 45l Tax Credit Cheers

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help